riverside mo sales tax rate

The 2018 United States Supreme Court decision in South Dakota v. The Riverside sales tax rate is.

Kansas City Cost Of Living Moving Com

There are a total of 456 local tax jurisdictions across the state collecting an average local tax of 2806.

. Estimated Combined Tax Rate 660 Estimated County Tax Rate 138 Estimated City Tax Rate 100 Estimated Special Tax Rate 000 and Vendor Discount 002. Has impacted many state nexus laws and sales tax collection requirements. The Riverside Missouri Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Riverside Missouri in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Riverside Missouri.

The state sales tax rate in Missouri is 4225. Sales tax rates make a difference when it comes to the final price you pay for goods or services. Wayfair Inc affect Missouri.

Riverside Horizons Community Improvement District. The County sales tax rate is. In our region Riverside maintains the lowest general sales tax rate of any full-service.

Average Sales Tax With Local. With local taxes the total sales tax rate is between 4225 and 10350. Riverside in Missouri has a tax rate of 66 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Riverside totaling 237.

Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Riverside MO. This tax also applies to the citys local use tax.

The Missouri sales tax rate is currently. Select the Missouri city from the list of popular cities below to see its current sales tax rate. Has increased the existing 14 percent city fire protection sales tax to 12 percent.

Sales Tax and Use Tax Rate of Zip Code 64150 is located in Riverside City Clay County Missouri State. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax. The Riverside Missouri sales tax is 660 consisting of 423 Missouri state sales tax and 238 Riverside local sales taxesThe local sales tax consists of a.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. 4 rows The 71 sales tax rate in Riverside consists of 4225 Missouri state sales tax. See how we can help improve your knowledge of Math.

Did South Dakota v. One of a suite of free online calculators provided by the team at iCalculator. Missouri has recent rate changes Wed Jul 01 2020.

5 State Sales tax is 423. One of a suite of free online calculators provided by the team at iCalculator.

With Exposed Brick Homes For Sale In Kansas City Mo Realtor Com

With Exposed Brick Homes For Sale In Kansas City Mo Realtor Com

Jackson County Mo Property Tax Calculator Smartasset

Uber Driver Salary In Riverside Ca Comparably

What Transactions Are Subject To The Sales Tax In Missouri

With Exposed Brick Homes For Sale In Kansas City Mo Realtor Com

Jackson County Mo Property Tax Calculator Smartasset

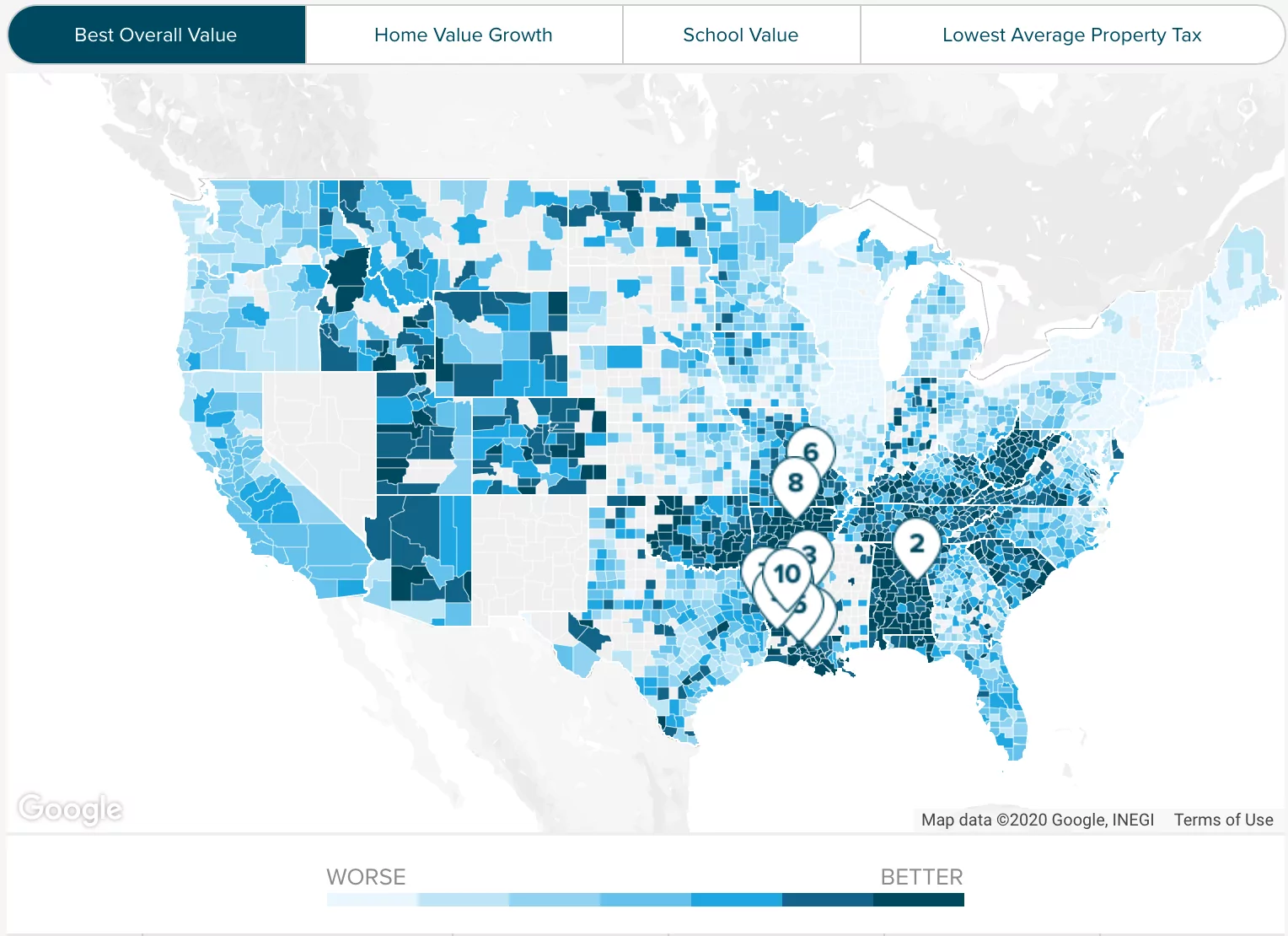

Missouri Property Tax Calculator Smartasset

Street Closure Map Kcmo Gov City Of Kansas City Mo

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Washington Sales Tax Rates By City County 2022

Jackson County Mo Property Tax Calculator Smartasset

With Exposed Brick Homes For Sale In Kansas City Mo Realtor Com

Kansas City Mo For Sale By Owner Fsbo 34 Homes Zillow

Jackson County Mo Property Tax Calculator Smartasset

Property Tax City Of Raymore Mo

2021 Best Zip Codes To Buy A House Near Kansas City Area Niche